Business Finance

Content

Long-term debt converts to short-term debt when the period left until the debt must be repaid becomes less than one year with the passage of time. Individuals who finance the purchase of high cost items, such as cars, for terms lasting more than a year are also taking on long-term debt obligations. Interest payments on debt are tax deductible, while dividends on equity are not. Returns to purchasers of debt are limited to agreed- upon terms (i.e., interest rates), however, they have greater legal protection in the event of a bankruptcy. The returns an equity holder can achieve have unlimited upside, however, they are typically the last to be paid in the event of a bankruptcy. Analyzing long-term liabilities often includes an assessment of how creditworthy a borrower is, i.e. their ability and willingness to pay their debt. Standard & Poor’s is a credit rating agency that issues credit ratings for the debt of public and private companies.

What are the 3 major types of long-term funds?

Long term loans are generally over a year in duration and sometimes much longer. Three common examples of long term loans are government debt, mortgages, and bonds or debentures. Different Financial Instruments: Long term loans are generally over a year in duration and sometimes much longer.

When there is a defined benefit scheme followed by an organization, pension liabilities occur. The main purpose of any kind of financing whether that is equity or debt is to raise capital to buy assets. Long term debt can also be used to leverage the company and to buy back the shares and to convert the company from public to private.

Treasury And Government Bonds

In addition to income statement expense analysis, debt expense efficiency is also analyzed by observing several solvency ratios. These ratios can include the debt ratio, debt to assets, debt to equity, and more. Companies typically strive to maintain average solvency ratio levels equal to or below industry standards. High solvency ratios can mean a company is funding too much of its business with debt and therefore is at risk of cash flow or insolvency problems. Balance SheetsA balance sheet is one of the financial statements of a company that presents the shareholders’ equity, liabilities, and assets of the company at a specific point in time.

. @narendramodi @AmitShah @PMOIndia @HMOIndia Increase in Credit disbursement is a NEGATIVE SIGN & not positive. US, EU & China are best examples of Credit based Economy & we shouldn't follow them since it is Debt Trap which has Short term +ve impact & Long term -ve impact. https://t.co/6pfTbDpPHR

— Gau₹av Khai₹at 108 🇮🇳 (@GauravKhairat) November 27, 2021

In this article, we discuss how to calculate total debt, learn the different parts of a balance sheet and take a look at a basic example. These are loans that will take more than 12 months to repay, known for their large principal amount and often their likelihood to accumulate interest to be paid over a period of time. These coupon payments are generally made regularly over the period of the bond.

How Do Bonds Affect Cash Flow Statements?

Some long term debts such as mortgage loans and serial bonds are retired in a series of annual, quarterly or monthly installments. Any portion of such long term debts or loans that matures within one year period of the balance sheet date no longer remains a long-term liability and should therefore be reclassified as current liability.

Until each month’s services has been redeemed, the service is deferred. These debts accrue interest each month until paid in full within the year or term of the agreement. Like checks, short-term notes or promissory notes contain terms that have been negotiated between the lender and borrower. Based on their risk, bonds are rated by rating agencies such as Standard and Poor, Fitch Ratings, Moody’s, etc.

How To Calculate Total Debt

Funds due to you that have yet to be paid will be accounted for in this section. Any outstanding bonds that the government has yet to repay to your business will be accounted for in this section. Seen more so as an investment than a liability, this is still recorded as a liability because the money has yet to be repaid. A continual decrease in a company’s debt-to-assets ratio can mean that the organization is increasingly less dependent on using debt to fund business growth. A healthy debt-to-assets ratio can vary according to the industry the business is in.

The lesser agrees to transfer the ownership rights to the lessee once the lease period is completed, and it is generally non-cancellable and long-term in nature. Interest Coverage Ratio is a financial ratio that is used to determine the ability of a company to pay the interest on its outstanding debt. From year 1 is paid off and another $100,000 of long term debt moves down from non-current to current liabilities. A debt issue is a financial obligation that allows the issuer to raise funds by promising to repay the lender at a certain point in the future. Under a field warehousing arrangement, the inventory is under the physical control of a warehouse company, which releases the inventory only on order from the lending institution. Canned goods, lumber, steel, coal, and other standardized products are the types of goods usually covered in field warehouse arrangements.

Stockopedia Explains Long Term Debt

Even though the loan isn’t paid off for many years, it still has a portion of the note that must be repaid each year. This is the current portion of the long-term debt– the amount of principle that must be repaid in thecurrentyear. “Notes payable” and ” Bonds payable” are common examples of long-term liabilities.

- Any loan that comes from a bank or any other financial institutions comes under bank debt.

- Gain the confidence you need to move up the ladder in a high powered corporate finance career path.

- The amount of deferred taxes a company reports on its balance sheet represents the money it owes for future income taxes.

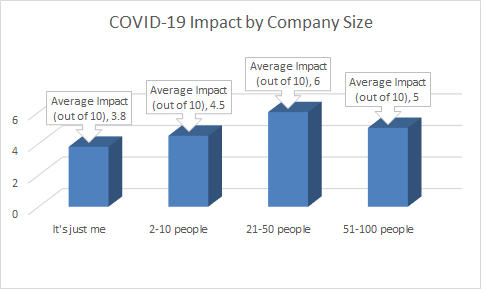

- Please consult the figure as an example of Standard & Poor’s credit ratings issued for debt issued by governments all over the world.

- Any organizational debt that will not be paid off within one year is classified as long-term debt.

- Liquidity ratios are a class of financial metrics used to determine a debtor’s ability to pay off current debt obligations without raising external capital.

- Longer-term debt usually requires a slightly higher interest rate than shorter-term debt.

Long term liabilities are stated in the Balance Sheet of the company. Companies use long term debt for various purposes which are in sync with their strategy. Advantages of long term debt that it can be paid easily over the years and the cost of debt is lower than the cost of equity. But companies need to keep in mind that they shouldn’t get overleveraged and then it may get hard for them to pay back investors. As we have seen each year company will pay back $100,000 from the loan. So that amount will be shown in the “Current portion of long term debt”. At that time, she was signing loan papers to purchase her first business location.

The Debt Ratio

For example, debt due in five years may have a portion due during each of those years. Each such portion would be considered current portion of long-term debt. Long-Term Debt.’ shall mean the total of all amounts included in the long-term debt of the Borrower pursuant to RUS Accounting Requirements.

Unconventional Ideas May Yield Better Returns – Forbes

Unconventional Ideas May Yield Better Returns.

Posted: Mon, 22 Nov 2021 08:00:00 GMT [source]

A capital lease is a temporary loan that allows renters to use the asset for the life of the lease in exchange for payment. The leased asset is subject to depreciation over the life of the lease. With employees on the payroll, businesses have a running wages payable account that includes the amount earned but not yet distributed in the form of a paycheck. Payment typically follows after the pay period in which hours were recorded. These expenses are accumulated by providing pension plans to employees, or by matching employee pensions as a form of payment. A necessary liability, this section of your balance sheet will include a large portion of the expenses you pay to employees in full. A company should take care that it keeps its long term liabilities in check.

Pension commitments given by an organization lead to pension liabilities. Pension liability refers to the difference between the total money that is due to retirees and the actual amount of money held by the organization to make these payments. Thus, pension liability occurs when an organization has less money than it requires for paying its future pensions.

The terms of such conversion shall be specified at the time of the issue. Special Purpose VehiclesA Special Purpose Vehicle is a separate legal entity created by a company for a single, well-defined, and specific lawful purpose. It also serves as the main parent company’s bankruptcy-remote and has its own assets and liabilities. Owners and managers of businesses will often use leverage to finance the purchase of assets, as it is cheaper than equity and does not dilute their percentage of ownership in the company.

Liabilities are always divided into short-term debt and long-term debt. Short-term debt is referred to as current liabilities and long-term debt as long-term liabilities. Every company needs funds to run its day-to-day business, buy fixed assets and for other business activities. Long term debts give the organization immediate access to funds without worrying for paying it in the short term. It is important to consider these off-balance-sheet-financing arrangements because they have an immediate impact on a company’s overall financial health. Another example of off-balance-sheet financing is an operating lease, which are typically entered into in order to use equipment on a short-term basis relative to the overall useful life of the asset. An operating lease does not transfer any of the rewards or risks of ownership, and as a result are not reported on the balance sheet of the lessee.

The debt obligations of a firm can be either short-term or long-term. How much of each type of debt a firm owes has a major impact on the firm’s liquidity, which is the business’s ability to meet its debt obligations. Although average debt ratios vary widely by industry, if you have a debt ratio of 40% or lower, you’re probably in the clear. If you have a debt ratio of 60% or higher, investors and lenders might see that as a sign that your business has too much debt.

- A lease contract, however, being a fixed obligation, is similar to debt and uses some of the firm’s debt-carrying ability.

- The current maturities of long-term debt is also part of the company’s definitely determinable liabilities, since it’s both known to exist and can be measured precisely.

- If the long-term debt coming due is going to be refinanced or retired using new debt.

- Bond values rise and fall according to a number of factors, including the interest rate paid by the bond and the length of time before the bond matures and the capital has to be repaid.

Interest from all types of debt obligations, short and long, are considered a business expense that can be deducted before paying taxes. Longer-term debt usually requires a slightly higher interest rate than shorter-term debt.

Bonds – These are publicly tradable securities issued by a corporation with a maturity of longer than a year. There are various types of bonds, such as convertible, puttable, callable, zero-coupon, investment grade, high yield , etc. Bank Debt – This is any loan issued by a bank or other financial institution and is not tradable or transferable the way bonds are. As shown above, in year 1, the company records $400,000 of the loan as long term debt under non-current liabilities and $100,000 under the current portion of LTD . Below is a screenshot of CFI’s example on how to model long term debt on a balance sheet. As you can see in the example below, if a company takes out a bank loan of $500,000 that equally amortizes over 5 years, you can see how the company would report the debt on its balance sheet over the 5 years.

If the company does well and its share price increases, the lender shares in the success of the company. If the shares do not increase in value, the company still has to pay interest on the bond and repay the capital when the term of the bond expires. The amount of deferred taxes a company reports on its balance sheet represents the money it owes for future income taxes.

Long-term liabilities, or non-current liabilities, are liabilities that are due beyond a year or the normal operation period of the company. The normal operation period is the amount of time it takes for a company to turn inventory into cash. On a classified balance sheet, liabilities are separated between current and long-term liabilities to help users assess the company’s financial standing in short-term and long-term periods. Long-term liabilities give users more information about the long-term prosperity of the company, while current liabilities inform the user of debt that the company owes in the current period. On a balance sheet, accounts are listed in order of liquidity, so long-term liabilities come after current liabilities. In addition, the specific long-term liability accounts are listed on the balance sheet in order of liquidity. Therefore, an account due within eighteen months would be listed before an account due within twenty-four months.

•Buying a car.

•Saving for a down payment.

•Paying off debt.Long Term Goals

These goals majorly focus on big picture goals with a timeframe that ranges from several years to decades.

Examples:

• Paying off a mortgage.

• Starting a business.

• Saving for retirement.— Abojani Investment🇰🇪🇺🇬🇹🇿 (@TheAbojani) November 29, 2021

Add the company’s short and long-term debt together to get the total debt. To find the net debt, add the amount of cash available in bank accounts and any cash equivalents that can be liquidated for cash. Small business owners want their long term debt examples businesses to succeed, especially when there is a great amount of time and money involved. The best way to track your expenses each month is through the use of a balance sheet, which includes the total debt or liabilities a business has.

If the company has established an asset to retire this debt, and that fund is not classified as a current asset. Long Term Debt may consist of long-term bank borrowings, bonds, convertible bonds, etc. Equity is a safer option for the reason that it is not mandatory for a company to pay dividends. However, if a company is issuing debt then interest payment is mandatory. Whilst you may have a vague idea about the differences between long-term and short-term debt, in accounting terms there are some very clear differences between the two.

The Debt-to-Equity Ratio is a financial ratio that compares the debt of a company to its equity and is closely related to leveraging. See below for the balance sheet reporting treatment of the current and long-term liability portions of the Note Payable from initiation to final payment. If a classified balance sheet is being utilized, the current portion of the long-term liability, if any, needs to be backed out and reclassified as a current liability. The CPTLD is found on the section of a company’s balance sheet that displays the total amount of long-term debt that should be paid by the end of the year. Anytime a business accepts prepayment for a service, such as cleaning the building, shredding documents, or providing a yearly online service at an upfront cost, it is categorized as deferred revenue.

The third section of the income statement, including interest and tax deductions, can be an important view for analyzing the debt capital efficiency of a business. Interest on debt is a business expense that lowers a company’s net taxable income but also reduces the income achieved on the bottom line and can reduce a company’s ability to pay its liabilities overall. Debt capital expense efficiency on the income statement is often analyzed by comparing gross profit margin, operating profit margin, and net profit margin.

Author: Maggie Kate Fitzgerald